A Guide To Real Estate Commissions For New Brokers

If you’re launching a new brokerage in 2025, standing out to potential agents won’t be easy—but it’s absolutely doable with the right approach.

Real estate agents have over 1.5 million brokerages in the U.S. to choose from, many offering competitive commission structures and attractive perks.

To recruit top talent and retain your agents, your commission process matters. A clear, motivating structure can be one of your strongest assets, but figuring out the right one (and how to calculate it) can feel complex.

In this article, we’ll break down why your commission strategy matters, how to choose the best structure for your business, and tips for simplifying the process as you grow.

Why Is It Important for Brokers to Pay Attention to Agent Commissions?

Implementing a fair and transparent commission structure can benefit your new brokerage in several ways:

➡️ Attract new talent

If you’re looking to recruit new agents, providing competitive commission structures can help you stand out in a highly competitive real estate industry.

Finding the right structure will help you attract experienced agents who can make positive contributions to your new brokerage.

➡️ Motivation and performance

For many agents, commission is their only source of income. And even if this isn’t the case, paying agents their commissions correctly and on time is still important.

Properly compensating agents boosts their motivation, leading to higher productivity and more closed deals.

➡️ Staff retention

If you want to retain your new real estate agents and earn their loyalty, real estate commissions should be calculated accurately and paid on time.

Also, if you offer competitive commission structures—which we will discuss later in this article—your agents are more likely to stay with your brokerage for longer. This reduces staff turnover and helps to build a stable and high-performing team.

➡️ Satisfied employees

Keeping your agents happy will help them perform at their best and secure more deals. Paying them the correct commission helps maintain agent satisfaction and creates a healthy culture within your new brokerage.

➡️ Increased collaboration

If you use a team split commission structure, for example, you can enhance collaboration across departments within your brokerage.

When teams are confident they’ll receive the appropriate commission, they tend to be more collaborative.

➡️ Enhanced client relationships

Clients will often ask the agents they work with about their real estate fees. If clients understand how agents are compensated, it can contribute to a positive client-agent relationship. This could potentially enhance your new firm’s reputation and help your agents close more deals.

What Is the Average Real Estate Agent Commission?

Before you decide on a commission structure for your brokerage, let’s discuss what most real estate agents earn in commission.

The exact terms of an agent’s commission vary from sale to sale. However, the average realtor commission is between 5 and 6% of the property’s selling price. This amount is typically divided between the listing agent and the buyer’s agent.

Some agents will lower their commission fees if they are representing both the buyer and the seller.

Sometimes, the commission is divided equally between seller and buyer agents, who each receive 3% of the fee. Alternatively, agents might opt for a different arrangement, such as a 60/40 split.

Let’s look at the average commission earned by selling and buying agents:

👉 Commission for the seller’s agent

The average selling agent commission in the U.S. is around 2.83%. This means that if a property’s sale price is $300,000, the seller’s agent will receive $8,400 in commission.

👉 Commission for the buyer’s agent

The buyer’s real estate agent can collect an average of 2.66% of the commission. On a $300,000 home sale price, buyer’s agents would receive a commission of $7,980.

| 💡 Commission Percentages Differ by State Although 6% is the average commission rate, this amount differs from state to state. For example, the average commission rate in Alabama is 5.45%, while in Delaware it’s 4.88%. You should research the commission laws and regulations in your state to ensure that your brokerage is compliant. |

Who Pays the Real Estate Agent’s Commission?

Typically, the seller of a property pays the real estate agent commission due on a deal. The commission fee is usually factored into the property’s listing price.

When a deal closes successfully, the seller pays the commission to the listing agent. They will then split a portion of the fee with the buyer’s agent.

In some cases, however, the buyer’s agents may have contracts stipulating that the buyer should pay the commission owed.

The way commission is paid at the end of a closed deal depends on the agreement reached between the agents involved and their clients.

| 💡 Is Commission Included in Closing Costs? Agent commission is usually not included in the property’s closing costs. Closing costs also include numerous brokerage fees, such as taxes, title insurance, appraisal, and lender fees. |

What Affects Real Estate Agent Fees?

When it comes to setting a commission rate, you must consider several factors:

📌 The property’s selling price

The final sale price of a home often has a large impact on commission. A property that is sold for a high price would naturally result in more commission. So, where the selling price is higher, agents may be willing to lower their commission fees.

📌 Client relationship

Agents may also want to tailor their fees based on the client’s individual needs. For example, if the client is selling multiple properties, it may be worthwhile for the agent to lower their commission to close these deals successfully.

📌 The complexity of the sale

Some properties are more challenging to sell than others. For example, a home that needs repairs wouldn’t necessarily be as attractive to buyers, making it harder to sell. On the other hand, some properties are in high demand and make for a simpler sale.

Real estate agents may choose to adjust their commission percentages based on the complexity of the buying or selling process.

📌 Market conditions

The market conditions in your area can influence the commission fee charged to clients. For example, if your region is currently a seller’s market, you may be happy to offer a lower buyer’s agent commission.

How to Calculate Real Estate Commission

To ensure you always pay your real estate agents the correct commission, you need to know how to calculate their earnings. There are three ways you can do this:

💰 Manual calculations

Manual calculations involve:

- Calculating the total commission on a sale based on the agent split.

- Subtracting off-the-top fees like franchise or royalty fees.

- Calculating how you split the commission amount between your brokerage and the agent.

- Accounting for other fees like errors and omissions (E&O) insurance and marketing costs.

The problem with calculating real estate agent commissions manually is that there is a lot of room for error. If you get one percentage wrong, it could throw off your entire calculation.

💰 Use an intelligent commission calculator

A more practical solution is to use a commission calculator designed to help brokers establish the amount due to their agents.

We’ve put together an intuitive real estate commission calculator that can help you determine agent fees based on various structures.

You can use our calculator to determine commission amounts based on the following models:

- A standard commission split.

- Tiered real estate commission.

- Flat-fee structures.

- Team split commission.

💰 Invest in commission automation software

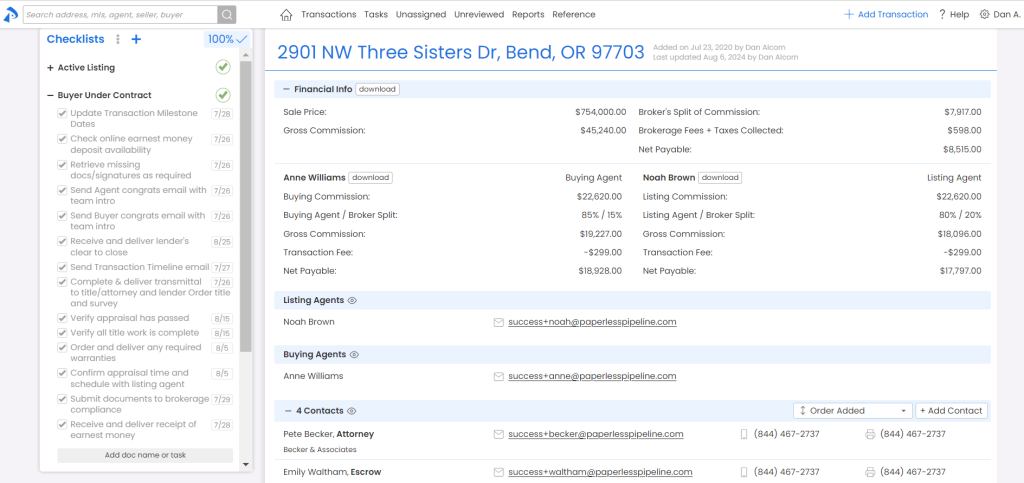

The most effective way to ensure you calculate real estate agent commission correctly is to use Paperless Pipeline’s commission module. This tool, available as an add-on to your subscription, simplifies the entire commission process.

Regardless of the commission structure you choose for your brokerage fee, our commission module fits seamlessly into your transactions.

This solution is another way to enhance agent satisfaction. Agents can easily access instant financial statements to see how much they’ve earned on a deal and what is due to them.

3 Commission Structures You Can Use in Your Brokerage

Now that you understand more about commission, it’s time to choose a structure for your new firm. Here are the three most common structures to consider:

➡️ 1. Percentage-based fees

This is the most commonly used commission structure. The agent receives a percentage of the overall commission based on the home’s purchase price. However, this amount varies according to the terms of the agent-client contract.

Calculations for this type of structure can be complex, as you’ll need to consider the:

- Sale price.

- Sale price after referrals or concessions.

- Gross commission after franchise fees.

- Distributable commission.

- Agent or broker commission.

These calculations are not straightforward, as they’re based on different amounts and varying stages of a commission calculation.

For example, the first multiple listing service (FMLS) fee is based on the sale price, while an agent fee may be based on the distributable commission.

The good news is that you can easily manage and automate all of your percent-based commission fees and instantly generate commission disbursement authorizations (CDAs) with Paperless Pipeline and the commission module.

➡️ 2. Fixed-fee commissions

In this model, the real estate agent receives a commission for their services in the form of a fixed fee rather than a percentage of the property’s selling price.

The commission amount remains the same regardless of the type of property or how the deal was closed.

There are upsides and downsides to this commission structure that you need to consider before implementing it:

Agent satisfaction

Real estate agents might not find a new firm that uses this model attractive. This is because they won’t have the opportunity to earn more if they close more deals or sell properties for a higher price.

Client satisfaction

Fixed-fee commissions could keep your clients happy. This model provides them with transparency about your fees and allows them to predict how much they’ll have to pay in commissions.

➡️ 3. Hybrid commission structures

This structure combines aspects of both percentage-based and fixed-fee models. It’s designed to give agents more stability and guaranteed income while still allowing them to generate additional earnings.

Agents would receive a fixed salary, which would be predetermined when you hired them. In addition to this base salary, they would also have the opportunity to earn commissions based on their real estate transactions. The commission would be a percentage of the sale price of a property or a fixed fee per deal.

This model may be appealing to agents who value financial reliability. It can also help to attract agents who are new to the industry and may need time to build a client base before they start earning commissions.

| 💡 Consider Incentives and Bonuses When weighing various commission structures, you should also consider offering agents incentives and bonuses. These could be for reaching specific milestones or for agents who exceed their performance expectations. Implementing a structure like this can motivate your new hires to excel in their work and contribute to the overall success of your firm. It also makes your firm more appealing to top talent. |

How to Choose the Right Commission Structure for Your New Firm

How do you choose the right commission structure for your new firm? Here are some tips:

✅ Research legal and regulatory compliance

As mentioned above, commission regulations vary by state. It’s important to familiarize yourself with the state and federal laws that govern real estate in your area.

✅ Run a competitive analysis

You might want to consider carrying out a competitive analysis of common structures offered by competing brokerage firms.

Understanding industry standards and how competitors compensate their agents will help you select a commission structure that keeps you competitive.

✅ Consider flexibility

You don’t have to choose one commission structure and apply it to every agent in your brokerage. Rather, you may want to think about offering more than one model to attract a diverse range of agents.

| 💡 The Importance of Transparency When you’re recruiting agents for your new brokerage, you should be completely transparent with them about the commission structure you’ve chosen. This helps build trust with potential hires and may even boost your firm’s reputation. |

Supercharge Your New Brokerage with Commission Management Automation

The fastest and most simple way to calculate commission fees for your agents is to use our commission module. With Paperless Pipeline’s commission module, you can:

✔️ Generate commissions seamlessly.

✔️ Get instant financial statements.

✔️ Customize and send CDAs.

✔️ View detailed individual financial commission reports.

✔️ Automate monthly production reports.

Automating the commission process helps to ensure you pay your real estate agents the correct amount and that they receive their transaction fees on time.

In doing so, you’re promoting agent satisfaction and retention and contributing to your firm’s sustained success.

If you’d like to see our commission module in action, visit our website to schedule a demo.