Everything You Need To Know About Starting A Real Estate Brokerage

The complete guide to starting your own successful real estate brokerage firm in 2025.

With almost 360,000 real estate firms in the U.S., launching your own brokerage comes with stiff competition.

Without the right strategy, your idea to start a brokerage can quickly become a waste of time and money.

Many new brokers struggle with mismanaged operations, unclear processes, and ineffective recruitment, all of which can prevent growth before you even start.

But by focusing on the right systems, team structure, and processes from day one, you set yourself up to attract top talent, close more deals, and build a profitable real estate company.

In this article, we’ll explain everything you need to know about starting a real estate brokerage, including how to avoid common mistakes and gain a competitive edge.

Step 1: Getting the Foundations Right

Any sustainable business is built on a solid foundation. Let’s take a look at what you need to do first before starting your brokerage:

Get your real estate broker license (or hire a licensed broker)

In the U.S., a real estate broker is responsible for the transactions processed under their license. This person is accountable for everything related to the transaction, including legal compliance and the performance of the real estate agents.

If you want to open a real estate firm, you need to get a license or hire someone to broker transactions.

Find out from your local Real Estate Bureau what the licensing requirements are for you or the broker you hire.

You typically have to complete a course ranging from around 40 to a few hundred hours, such as the LRE8170 Broker Pre-License and LRE8171 Applied Real Estate Principles courses offered at Harper College. You may also need some prior experience as a real estate agent to qualify for a broker’s license.

The U.S. Small Business Administration website also has valuable information on the permits you may need to operate your brokerage, depending on your state.

Decide on a business structure

One of the first things to decide on is the business structure. Your business entity could be a sole proprietorship, limited liability company (LLC), partnership, or corporation:

- Sole proprietorship: The simplest and most affordable structure, ideal if you’re starting small and want complete control. However, you assume full personal liability for debts and legal issues.

- LLC: A popular choice for brokerages because it offers liability protection while keeping paperwork and taxes relatively straightforward. This structure separates your personal assets from business liabilities.

- Partnership: Best if you’re launching your brokerage with one or more co-owners. Partnerships allow you to share responsibilities, resources, and profits, but they also require clear agreements to avoid disputes.

- Corporation: A more complex structure that provides the strongest liability protection and makes it easier to raise capital. However, it involves more regulations, higher costs, and additional tax considerations.

Most people operate their brokerage as a limited liability company (LLC), as it is a simple business structure that lessens personal liability and often provides better protection of your personal assets. You won’t require a board of directors or need to hold formal shareholder meetings.

Start with a minimum viable brokerage

Unless you have startup capital and experience, we recommend beginning with a minimum viable brokerage.

This means you’ll launch with a minimum investment and the basic infrastructure, which allows you to adapt quickly and scale appropriately.

A minimum viable brokerage typically includes just the essentials: your broker license, a simple office setup, transaction management software, and a small team or solo operation to start generating revenue without unnecessary overhead.

Choose between a franchise and an independent brokerage

Another important decision you’ll need to make is whether to run an independent brokerage or join a real estate franchise. Both options have advantages and considerations, so you’ll need to evaluate what aligns best with your goals and resources.

Franchise option

Joining a franchise offers instant brand recognition, proven business systems, and ongoing support for your new business. However, investing in a franchise can be expensive.

For example, a franchise with Keller Williams requires a $35,000 franchise fee and an initial investment ranging from $183,230 to $336,980.

These fees may be worth it when you consider that you’ll gain access to established training programs, marketing and lead generation tools, and a nationwide network of agents.

Independent brokerage

An independent brokerage gives you full control over your brand, systems, and policies. While this route often requires more effort to build recognition and establish processes, it offers greater flexibility and can be more affordable than a franchise.

You set your own commission structure, marketing approach, and culture without needing to conform to franchise rules or fees. This is ideal if you have a strong vision and want complete control over your business.

Will you do the selling or hire agents?

When you first start, you will probably perform the duties of a real estate agent and a brokerage owner. You’ll need to find leads and market properties, organize tours, and facilitate transactions.

This is beneficial in the early years of your real estate brokerage firm as it eliminates agent fees and commissions. You also get to keep all the profit and reinvest it in your business. The downside is that doing everything yourself means growth will be slower.

You may want to hire real estate agents to work for you, as the more people you recruit, the more deals you can close, and the more commission you can earn.

| You Need a System for Recruiting Check out our article about Robb Campbell. He is one of the country’s top real estate recruiters, and he revealed the system he uses to recruit agents for his business. |

Take financial planning seriously

Another important step is to create a real estate business plan with detailed financial projections. Entrepreneurs with business plans are 152% more likely to start their ventures successfully.

A business plan that covers financial aspects ensures you understand how many sales you must make for your business to be sustainable.

The first thing to consider in your real estate finance plan is startup costs. A virtual minimum viable brokerage with you performing the role of agent requires the least amount of money.

This would require you to invest in:

- Business registration.

- Insurance.

- Essential equipment.

- Reliable transaction management software.

The cash you need quickly rises if you want to open a brick-and-mortar location. You must factor in office space, furnishing, and labor costs. We’ll discuss brick-and-mortar offices in more detail later.

You’ll also need to address how you will finance these costs within your business plan. You may have money saved up that you can use to get started, or you may decide to apply for financing via the Small Business Administration.

Costs only increase once you’ve started your brokerage. You’ll need to cover:

- Marketing.

- Utilities.

- Staff expenses.

- Rent.

- Agent commissions.

- Franchise fees.

- Association and multiple listing service (MLS) fees.

Step 2: Choose a Business Model

Once you have the basics covered, the next step is to choose how you’re going to run your business:

A brick-and-mortar office

Many firms still operate from a physical office, and for a good reason. An office allows employees to work, hold meetings, and communicate with others. All the equipment people need is in the office, and many real estate agents expect you to have one.

Having a favorable street presence can also improve your visibility in the area. It encourages people to drop in when they are interested in selling or buying a home. This may be essential for dealing with customer groups who still prefer to visit a physical location.

The biggest downside to the brick-and-mortar model is the cost required to run an office. For example, on average, you’d have to spend between $500 and $3,000 per month just on office space and up to $10,000 on equipment and supplies. Additionally, many agents will spend much of their day in the field, even if they have an office.

A virtual brokerage

Running a virtual real estate brokerage has many benefits. You save significantly on the cost of office space, and it’s easier to scale up and add people to your real estate team without worrying whether you have room for them.

It’s suitable for agents, too. Around 65% of real estate agents say that remote work increases their productivity. Instead of commuting to the office, they can work at home and go straight to meet clients, possibly saving hours each day.

For this reason, offering flexible remote working arrangements can make recruiting easier.

The downside is that agents won’t have space to meet clients, which can be problematic on occasions when in-person meetings are necessary.

Moving to a remote work environment requires reliable cloud-based tools that keep your team connected and your transactions running smoothly. With the right systems in place, you can manage deals, share documents securely, and communicate with your team and clients from anywhere.

| You Need the Right Technology to Make a Remote Business Work Technology means that many tools previously required to run a successful brokerage are now redundant. Agents can scan documents on the go with their phone cameras, send them to you by email, and review documents on their computers. Meanwhile, tools like Zoom and Slack help keep the team in reach when needed, and transaction management software keeps deals running smoothly. |

A hybrid model

In a hybrid business model, which is being implemented by around 78% of real estate companies, most work occurs in the field. Agents still send digital documents and communicate with the team online, but you have a small office space.

This typically entails a limited number of meeting rooms or hot desks that agents can use when needed. You’ll save on property costs as you rent a smaller space, but you’ll still get many of the benefits of an entire office.

Another option is to take advantage of a coworking space if it is available in your city. These are often open-plan offices shared with other businesses.

A team structure business model

Brokerages are typically viewed as competitive places to work, and agents control the whole sales process and take home the rewards.

In a team brokerage, agents intentionally work together and share sales.

Each has a manager and plenty of support staff that help bring in sales, and agent commission is much lower to cover the extra costs, but good teams can sell at a higher volume.

It’s also more attractive to clients who benefit from the more service-oriented focus of these businesses.

Step 3: Start Closing Real Estate Transactions

Now it’s time to start closing deals. These first few deals are often the hardest, as you may be starting from scratch in terms of leads, reputation, and client base. Of course, this is unless you already have an existing network in your area due to your real estate experience.

As getting cash flow to cover your costs is essential to running a business, we recommend that new real estate brokers focus on getting their initial deals over the line.

If you have already established yourself in the real estate industry, you may have a network you can rely on for referrals. This is an ideal scenario, as people will trust you.

Let other Realtors know you’ll be willing to pay them a commission for any property listings they pass on to you. This can be a good source of referrals, as popular realtors often receive leads they can’t or don’t want to list.

You can also offer several buyer and seller incentives to make your brokerage stand out. Each has its own unique benefits and downsides. Here are some examples:

1% fee

HomePros offers a 1% fee, much lower than the average 3% commission. Lower fees appeal to sellers as they pocket more of the sale total.

While you’ll earn less per sale, you may be able to stay profitable by taking advantage of cheaper online marketing techniques to sell homes, reducing commission splits, or processing a higher volume of sales. The downside is that attracting talented agents may be more challenging.

Flat-fee brokerage

Brokerages can differentiate themselves by offering to work for a flat fee. You’ll offer your services at a predefined cost that won’t change, no matter how much the home sells for.

The benefit to the client is that they know exactly how much their fees will be up front. If their home sells for the expected amount, they will save a percentage of the sale price.

Homie, a flat-fee brokerage, says that the average client saves around $10,000 when they choose its services. This is a significant figure that will be very attractive to sellers.

The brokerage benefits from a guaranteed amount of money, even if the sale price is less than expected.

Minimum service flat fee

Some brokerages offer a flat fee model where they provide a minimal service, such as listing the property on an MLS, but then they let the seller take care of finding a buyer.

The brokerage doesn’t assign the seller and agent, market the listing, arrange home tours, or take photos.

The benefit of this basic service to the seller is that the fee is much lower. If they can get a deal through, they will save considerable fees. The brokerage’s benefit is that agents can work on other deals without earning as much for the sale.

Express sale

Selling a home is often an inconvenient and stressful experience for the owner. As a result, some brokerages provide a new service, sometimes known as an “express sale.” This is when they give the seller a fast cash offer, buy the property from them, and sell it themselves.

For the seller, the benefits are more flexibility and a quick, stress-free sale. However, they won’t take advantage of real estate market demand, and the offer they get may be relatively low.

The benefits for the brokerage include more potential profit and more predictable buying processes. The downside is that you’ll need a lot of free capital to buy the home, and you risk losing money on some properties.

Step 4: Choose a Commission Structure

Real estate commission on a property sale is typically between 5% and 6%, and this is split between the buying and selling brokerage and agents.

There are a few real estate commission plans that may complement the way you run your business:

Traditional commission split

A traditional commission split sees the total commission divided between the agent and the broker-owner.

The exact split will be decided when the agent joins your brokerage. Usually, the agent pays between 10% and 40% of the amount they receive to the broker.

This structure encourages agents to keep bringing in deals, as the more transactions they close, the more they earn.

Sometimes, percentages change depending on where the lead comes from. If the agent brings in the lead, they may receive a higher percentage of the deal, or if it comes from the brokerage, the company can collect more money.

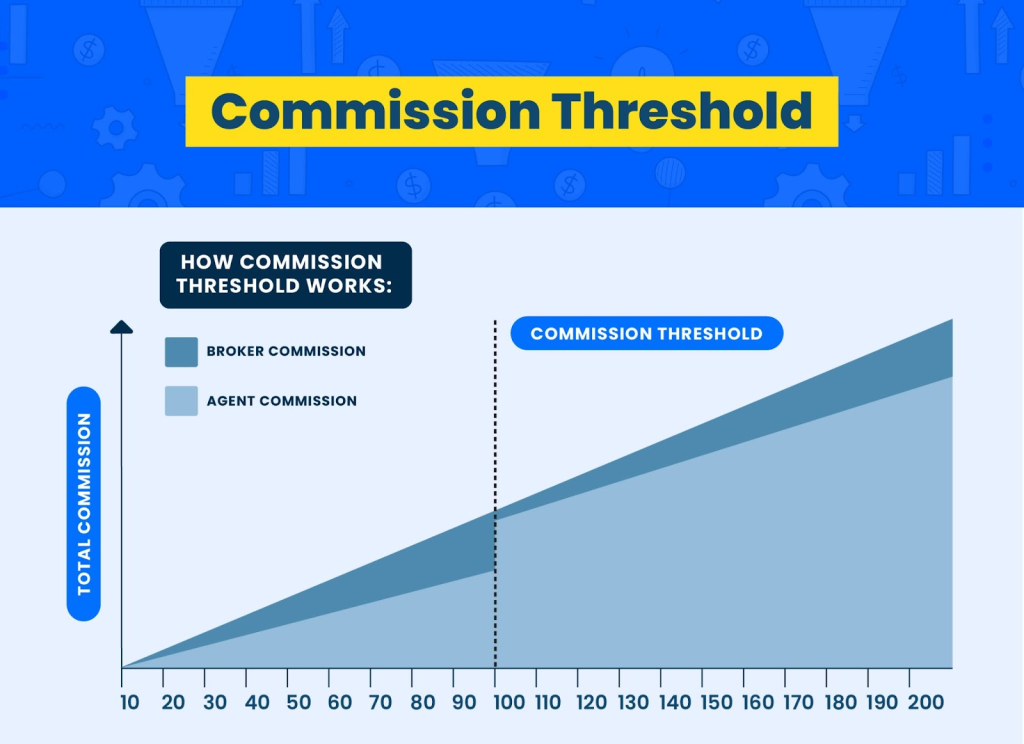

Commission threshold

A commission threshold is similar to a traditional split. The difference is that the percentage the agent pays to the broker reduces once they pass a monthly sales target.

For example, the agent may keep 60% of their first three sales in a month. Then, after the third transaction, they earn 70%. In some cases, there is even a third tier.

The benefit of this type of structure is that agents stay motivated once they have brought in a significant sales volume, potentially increasing the amount you make as a broker.

This type of structure is also likely to attract quality agents who are confident in their ability to push sales over the line.

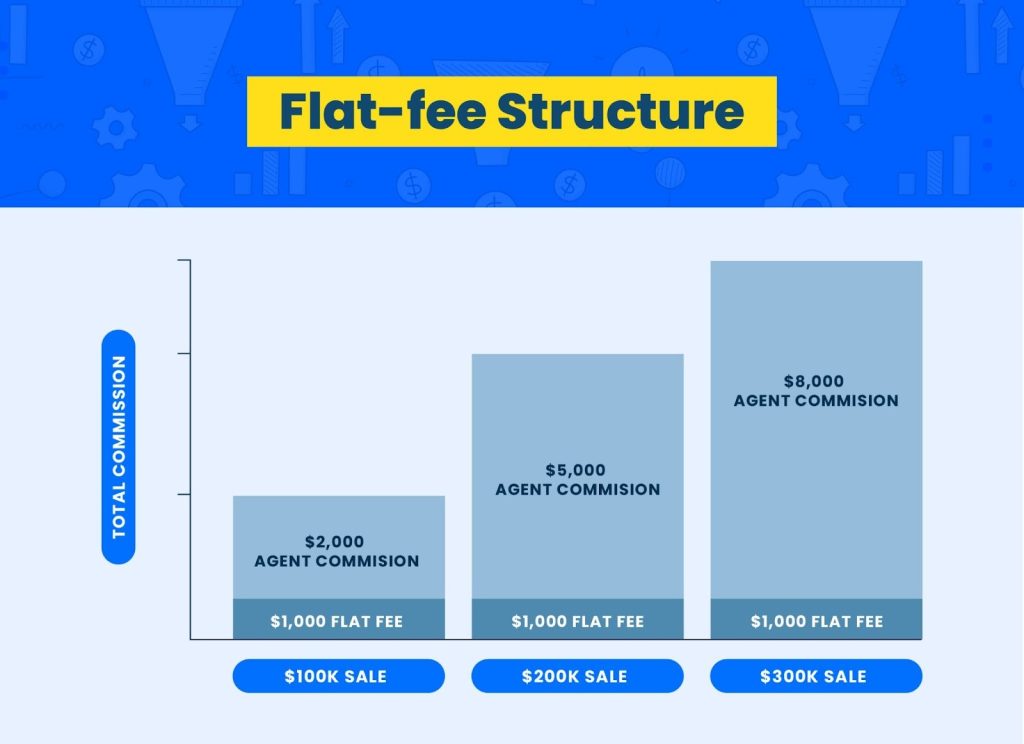

Flat-fee structure

In a flat-fee structure, the agent keeps 100% of the commission but pays a regular flat fee to the brokerage. This fee, often called a desk fee, is paid monthly or per transaction. It allows the agent to use the brokerage’s office and other infrastructure.

Monthly fees are paid whether or not the agent closes a deal during the period.

The benefit to the brokerage is that it receives a guaranteed income. It also typically provides agents with less support and doesn’t pay for signage or advertising, for example. This can significantly lower their costs.

The downside is that a brokerage won’t earn as much from productive agents as a traditional commission model.

This structure typically attracts experienced agents who generate consistent revenue and close deals without much support.

| Use a Commission Calculator Once you’ve selected a commission structure for your brokerage, you can use our intuitive calculator to work out commissions. |

Step 5: Use Best-in-Class Real Estate Software

Brokerage management software helps you streamline processes and scale your business. It’s crucial to choose solutions that agents and other employees find easy to use and fit with their day-to-day workflows. Here is the essential software to invest in when starting a real estate brokerage:

1. Real estate compliance software

Real estate compliance is one of the biggest challenges new brokers face. Between federal regulations, state-specific laws, and local association rules, there’s a lot to keep up with, and mistakes can be costly.

Noncompliance can result in fines, legal disputes, a damaged reputation, and even the loss of your license.

That’s why it’s important to build compliance into your business processes from the very beginning. Establishing clear procedures, standardizing document management, and keeping a complete record of every transaction ensures you stay in line with regulations while protecting your brokerage from unnecessary risk.

This is where real estate compliance software becomes essential. Instead of relying on paper files, email chains, or generic file storage tools, compliance software provides a secure and centralized system to manage everything in one place.

Paperless Pipeline, for example, is purpose-built with real estate compliance in mind. It includes features like secure document storage, audit trails, and easy access controls.

2. Accounting software

Reputable accounting software is important as it tracks all your spending and transactions, and is even more beneficial when you need to submit your tax return.

Xero and QuickBooks are great examples of popular accounting platforms that easily integrate with other software.

3. Real estate transaction management software

Managing the real estate transaction process can be overwhelming. Investing in transaction management software is a good idea once you have your first deal under your belt.

A product like Paperless Pipeline allows you to digitize and automate the entire transaction process. With our software, you can:

- Create transaction checklists that guide your team through all the steps, from listing to closing.

- Automatically set dates so admins and agents can see when tasks are due, ensuring deals stay on track.

- Generate reports that show crucial transaction information. For example, the number of deals expected to close within the next 30 days or those closed in a certain period.

- Upload and review documents from anywhere, enabling a completely remote way of working.

- Integrate your account with over 3,000 commonly used apps.

4. Real estate commission management software

Once you’ve started employing agents, you’ll need commission management software. This is because over a third of employees will quit a job if they’re paid incorrectly. Commission management software helps avoid losing team members by automatically tracking sales and calculating commissions based on your agreed-upon structure.

With our Commission Module, you can view commission reports, manage plans, and assign agents to unique commission structures.

Additionally, agents can view their own income reports in a few clicks, allowing them to see how much they’ve made and what they can expect to make in the near future.

5. Integration tools

As your brokerage grows, you’ll likely start relying on multiple tools at once. While each plays an important role, they often work in silos, which can create inefficiencies and cause your team to duplicate work.

Integration tools connect your different platforms so they can share data and trigger actions automatically. Instead of manually moving information from one system to another, integrations ensure your apps work in sync, saving time and reducing the risk of errors due to manual work.

Popular tools like Zapier allow you to automate essential functions across your apps, freeing up your time and reducing human error.

6. Customer relationship management (CRM) software

Customer relationship management (CRM) systems allow you to manage and organize customer data, track sales, and plan and execute marketing campaigns. They also gather customer interactions from across your channels and record them in a single place.

You’ll probably need a CRM to help you manage cold leads. This will add to your marketing expenses, so we recommend choosing a good-quality free tool like HubSpot.

The type of brokerage that you operate will impact which CRM you choose. If you are a producing broker, consider allowing your agents to select their own CRMs to keep their leads confidential. As a managing broker, you will likely supply your agents with a CRM.

Start Your Own Real Estate Brokerage with the Right Tools

Starting a real estate brokerage is an exciting step, but it comes with challenges. These include staying organized and compliant while competing with top firms in your area.

Without the right systems in place, it’s easy to get bogged down in paperwork, miss critical transaction steps, or waste time on manual processes.

Paperless Pipeline is built specifically for real estate brokerages, helping you automate your entire transaction process, maintain full compliance, and save time on repetitive tasks.

With our software, you’ll have the foundation you need to scale, reduce costly mistakes, and run your brokerage efficiently from day one.

Try our tool out for free for 14 days today without being tied into any agreements or providing your credit card details. We’re excited to join you on your journey toward becoming a successful and profitable brokerage!