Errors And Omissions Insurance: Real Estate Basics You Need To Know

The frequency of lawsuits filed against real estate professionals increased by 9% in the two years before January 2023.

This was accompanied by a 13% increase in the severity, with realtors who lost a case paying an average of $39,000 in damages or charges.

Regulations are tightening, and client expectations are increasing. That’s why realtors need errors and omissions (E&O) insurance to protect them when things go wrong.

Agents, brokers, and other real estate professionals deal with large sums of money, regulatory processes, and outside parties.

If something goes wrong, you could face a serious lawsuit that could result in penalties or hefty fines.

This article discusses errors and omissions insurance in real estate, what it covers, and its exclusions.

What Is Errors and Omissions Insurance and Why Is It Important?

E&O insurance is professional liability insurance that covers businesses or individuals for mistakes or oversights. It provides coverage for legal claims made by clients for poor-quality work or negligent actions.

Errors and omissions insurance helps protect real estate firms, appraisers, and agents from mistakes made in the professional services they provide.

For example, if you provide professional real estate services and a client sues your business for a mistake or oversight, E&O insurance can help cover your legal costs.

Overall, E&O insurance is a key part of any real estate brokerage’s risk management plan.

What Does Real Estate Errors and Omissions Insurance Cover?

The coverage of E&O insurance may vary from one insurance company and policy to the next. In general, real estate errors and omissions insurance provides coverage for:

- Mistakes.

- Oversights.

- Negligence.

- Undelivered services.

- Missed deadlines.

When you purchase real estate E&O insurance, you enter into an agreement with an insurer. They will pay for related losses up to your omissions insurance program limits as long as you pay your premiums.

Under this arrangement, the insurer agrees to:

- Provide you with an attorney.

- Pay your legal dispute fees.

- Cover any court judgments.

- Provide funds for plaintiff settlements.

- Pay court costs, expert witness fees, and administrative costs.

With some policies, you can buy an extended reporting period (ERP), meaning you have more time to report a claim after your policy expires.

The insurer will provide comprehensive protection for:

Professional negligence

Negligence could stem from an agent failing to uphold professional standards or from errors, such as typos in legal contracts.

A common reason for lawsuits initiated against realtors is when they omit information that could have deterred the client from buying the property. This includes serious issues like:

- Water seepage in the basement.

- Termite damage.

- Black mold.

- Ice dams on a roof.

Other negligence claims covered by real estate errors and omissions insurance include:

- Dual agency.

- Breach of fiduciary duty.

- Real Estate Settlement Procedures Act (RESPA) violations.

Professional mistakes

Making a mistake in the documentation or marketing a property incorrectly can cost your client money or even cause the deal to fall through.

This could result in a court case or cause reputational damage that might damage your career. Diligence and attention to detail are your best and first line of defense.

But mistakes do happen, and when they do, E&O insurance will cover you for any legal defense costs you may have to pay.

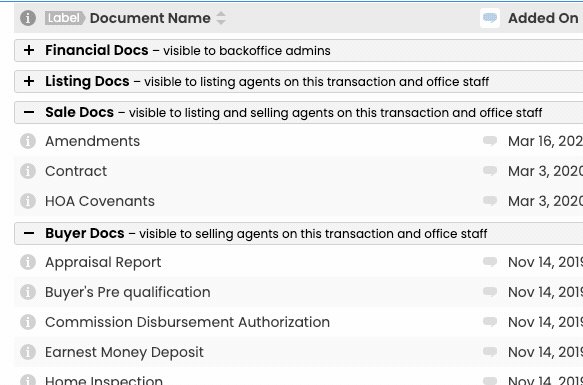

| How Paperless Pipeline Helps The entire real estate transaction process can be overwhelming. There are many rules and regulations, deadlines, and tasks to be accomplished. With so many steps and documents to keep track of, mistakes can happen. Paperless Pipeline helps you manage your property transactions to ensure you don’t make any errors. Here’s how: Create powerful checklists: Customize and automatically apply checklists based on the type of deal, the size, the location, and each separate stage or status. Make document reviews simple, easy, and quick: You can review documents, send notes, and approve steps from anywhere and on any device. |

Failure to deliver promised services

This happens when you fail to follow through with repairs, paperwork, or any other task related to the sale that was your responsibility to complete within a given time frame.

What Doesn’t Real Estate Errors and Omissions Insurance Cover?

Knowing what isn’t covered by E&O policies is crucial. Claims not covered by errors and omissions insurance include:

- Customer injuries.

- Employee injuries.

- Contingent bodily injury.

- Employee discrimination claims.

- Damage to business property or customer property.

Other types of business insurance policies can cover these claims.

Exclusions from Real Estate Errors and Omissions Insurance Policies

Exclusions are events and costs not covered by your policy. Typical exclusions for E&O insurance are:

Agent dishonesty or fraud

If you aren’t honest about a property or commit fraud when working on a deal, your errors and omissions policy will not cover you. This is considered criminal activity.

Your claim could be rejected if you deliberately omit even the smallest detail. For example, if you haven’t disclosed a crack in the plaster of a wall that costs a lot to repair, an insurance company may not cover you if the buyer sues you for this.

Causing damage to property

Errors and omissions insurance doesn’t cover a real estate agent if they damage a property.

This property damage, such as accidental damage to the home, would be covered by general liability insurance, so having this in place is also a good idea.

Failing to disclose knowledge of pollution

Polluted property is another exclusion in E&O insurance. In almost every state, agents are legally required to disclose knowledge of waste since it poses health and safety risks.

Who Needs Errors and Omissions Insurance?

Many businesses and professionals in the real estate industry need employment practices liability coverage, including:

- Real estate brokers.

- Agents.

- Property managers.

- Appraisers.

Even though E&O insurance is highly recommended for real estate professionals, it is only legally required in certain states.

Understanding your local laws is essential, as insurance requirements and industry regulations vary from state to state.

Is Having Errors and Omissions Insurance a Legal Requirement?

Whether or not you legally require errors and omissions insurance depends on the state you operate in.

Licensees in the following states are obligated to have an active policy:

- Colorado

- Idaho

- Iowa

- Kentucky

- Louisiana

- Massachusetts

- Mississippi

- Montana

- Nebraska

- New Mexico

- Rhode Island

- South Dakota

- Tennessee

- Wyoming

However, it is a good idea to have errors and omissions insurance, even if your state does not require it. This ensures that you are protected in the event that something goes wrong.

What Does E&O for Real Estate Professionals Cost?

Errors and omissions coverage on average costs between $500 to $1,000 per employee per year. Large agencies could spend up to $50,000 annually on E&O insurance.

However, this is a rough estimate, as the nature of your real estate business and various other factors affect the actual costs.

The cost of E&O insurance depends on the following:

Business size

A larger real estate agency means higher risks. Small businesses typically have fewer employees and lower insurance rates, so rates would be the cheapest for independent realtors.

Revenue

Your chances of facing litigation increase as your clients’ budgets and your income increase.

Your industry and the types of risks you face

Commercial real estate, for instance, carries more risks than residential real estate.

Employee training

Educating your employees on how to reduce risk can lower your insurance premium. If you show evidence of having invested in employee training, your team is more likely to be viewed as competent and less of a risk to insure.

Location

The cost of your E&O insurance can vary from one state to another. Also, depending on where you sell real estate within your state, county, or city, you may be regarded as a higher or lower risk to insure.

Claims history

If you have a history of lawsuits against you, insurers will see you as a major risk. This typically means that your E&O will be much more expensive, or you could even be denied coverage.

Coverage limits

The extent of coverage provided and the insurance limits of the policy you opt for will also see the total cost rise or fall. Higher insurance coverage typically comes at a higher premium.

How to Make a Claim on Your E&O Policy

If something has gone wrong with a transaction and someone is threatening you with legal action then you may need to make a claim.

Every situation is different; however, you will generally want to follow these steps:

- Check your policy documents: Check you are covered for the situation you may have to claim for.

- Gather your details: Prepare details that you will have to submit to make the claim. Examples include your policy number and contact information. You’ll also need to prepare a brief description of the incident, including when you became aware of it.

- Contact your insurance agent: Give them your details, explain the incident and ask questions about what will happen if it goes to court.

- Document everything you discuss: It’s a good idea to keep records so you can remember what you need to do, as well as what the insurer said they will do.

- Contact an attorney if necessary: You may need to hire a licensed E&O attorney to support you in your case.

Avoid Costly Mistakes with Paperless Pipeline

Reduce your risk of mistakes by investing in transaction management software like Paperless Pipeline, which is designed to protect your real estate business.

Visit our website and try Paperless Pipeline yourself with a free 14-day trial. We’re excited to show you how our software can help you avoid costly mistakes.